The inherent dynamic nature and lack of safety nets have always made financial markets a quagmire of challenges for investors. It’s like walking a tightrope with the risk of market volatility and manipulation threatening to throw you off your guard at every turn. However, what if you had a personal trading assistant, run on a powerful AI model, to assist you with the most up to date insights, trustworthy recommendations and personalized strategies? FinTractiv AI, VE’s revolutionary upcoming trading platform, is about to do just that, transforming the way individual traders and investors navigate the markets.

Now, if you think FinTractiv is like the other dime-a-dozen trading bots popping up everywhere on the internet these days, you would be mistaken. It’s more of an intelligent trading partner that constantly provides you with actionable insights, risk-management tools that actually work, and a walk-in-the-park smooth user experience. So, without further ado, let’s find out what makes FinTractiv tick.

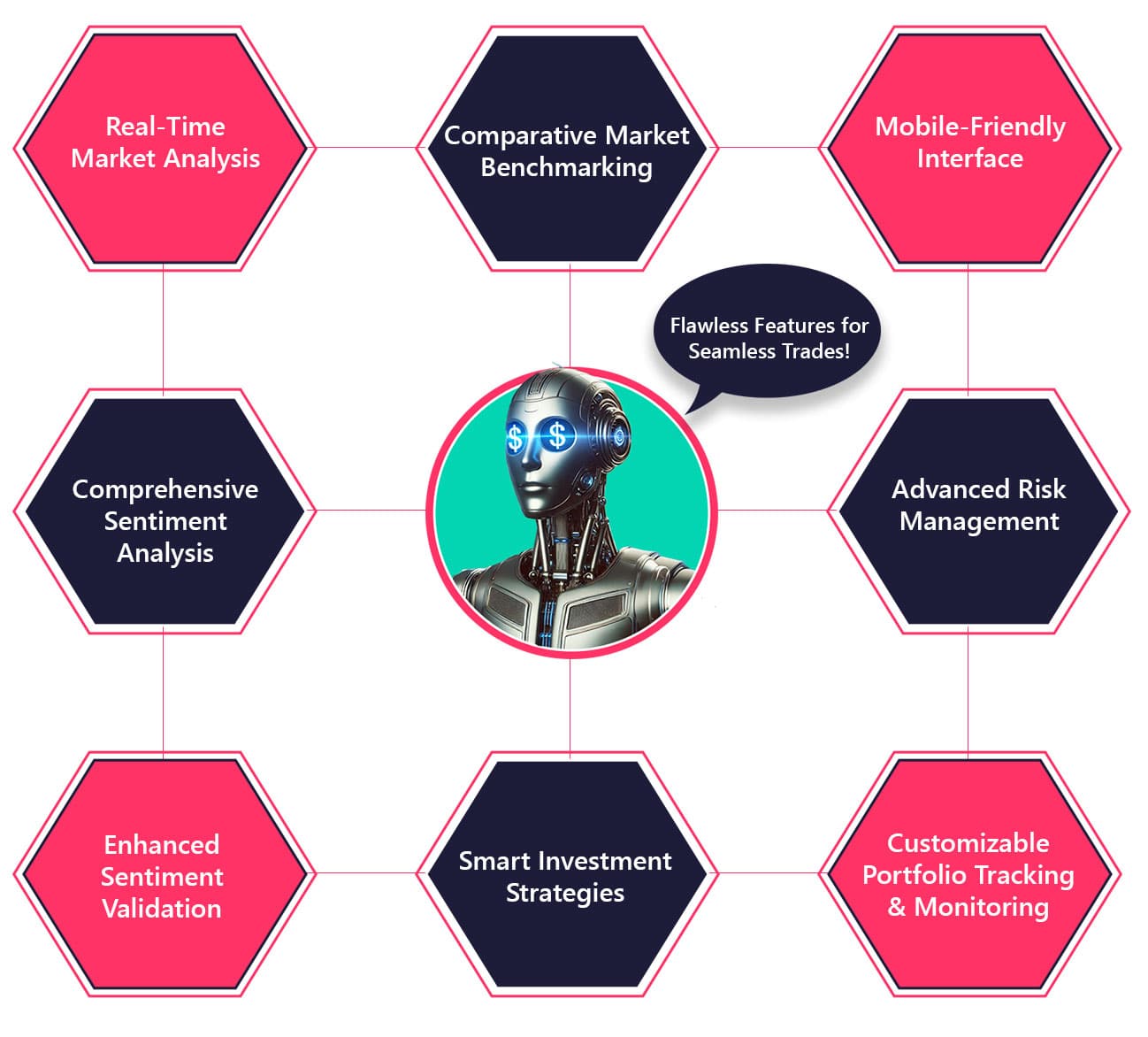

Features of FinTractiv AI

FinTractiv AI promises a treasure trove of features designed to meet the diverse needs of its users. From beginners dipping their toes into trading to seasoned professionals seeking an edge, this platform will cater to everyone.

1. Real-Time Market Analysis

FinTractiv AI’s real-time market analysis engine is at its core. It will integrate APIs from the major stock exchanges, cryptocurrency markets, and commodity platforms to provide traders with the most up-to-date data, such as the following:

- Fundamental metrics like earnings reports and price-to-earnings ratios, which shed light on a company’s financial health.

- Information to help predict market trends and technical indicators (historical price movements, trading volumes, and volatility indices).

- Patterns and trends discovered by advanced integrated AI models such as LSTM and ARIMA.

2. Comprehensive Sentiment Analysis

Social media chatter, financial news and forums will be tapped into by FinTractiv AI to understand the market’s pulse. It will use powerful Natural Language Processing (NLP) models such as BERT and RoBERTa to classify the sentiment toward a particular stock into positive, negative, or neutral. Unique features will include:

- Keeping an eye on the number of mentions of certain assets.

- Sentiment score assignment tuned to the mood of the crowd.

- A credibility filter that will use more reliable sources instead of potentially manipulated data.

3. Enhanced Sentiment Validation

Social media buzz can be deceptive. FinTractiv AI will go the extra mile to protect users by cross-validating sentiment data with market statistics. If a sudden surge in positive sentiment isn’t backed by corresponding trading activity or institutional interest, the bot will flag it as a potential risk, warning users to tread carefully.

4. Smart Investment Strategies

FinTractiv AI will first segregate users based on their experience, and then its recommendation engine will take into account their personalized trading needs while recommending strategies. For example:

- It will suggest low-risk strategies and educational resources for beginners.

- It will analyze portfolios of intermediate-level traders and recommend trades that match up with individual goals.

- It will simulate strategies using reinforcement learning for advanced users to find the most profitable approach.

All recommendations will be based on fundamental, technical, and sentiment analyses to provide a holistic view of market opportunities.

5. Customizable Portfolio Tracking & Monitoring

Users will have complete control over their portfolios, with tools to:

- Select specific stocks, commodities, or indices to monitor.

- Track portfolio performance metrics such as Sharpe Ratio and Maximum Drawdown.

- Receive real-time notifications about market trends and suggested actions.

6. Advanced Risk Management

Trading is supposed to be risky, but FinTractiv AI will make it safer with:

- Stop-loss and take-profit triggers to automatically exit trades based on user-defined criteria.

- Sophisticated risk assessment models like Value at Risk (VaR) and Conditional Value at Risk (CVaR) to estimate potential losses.

- Automated, dynamic, and emotion-free trading decisions to eliminate impulsive moves.

7. Mobile-Friendly Interface

FinTractiv AI recognizes that accessibility is key and will provide a mobile app that mirrors all of the platform’s features, such as receiving instant alerts and auto-executing trades. Traders will be able to track their performance, view recommendations, and keep pace with the curve at any time and anywhere with a sleek, user-friendly dashboard.

8. Comparative Market Benchmarking

By providing a context and perspective on trading outcomes, the Comparative Market Benchmarking feature will help investors compare their portfolios’ performance against big indices like S&P 500 or Nasdaq Composite.

The Technical Backbone of FinTractiv AI

Building a platform as ambitious as FinTractiv AI requires a robust and scalable technical infrastructure. While the complexities under the hood are mind-boggling, here’s a simplified overview of how the system will work from an investor’s perspective.

- Data Collection and Processing – FinTractiv AI will aggregate massive amounts of data in real time, spanning stock prices, cryptocurrency movements, and news sentiment. Using machine learning models like LSTM (for time-series analysis) and NLP tools like RoBERTa (for sentiment classification), it will process this information into actionable insights.

- Custom AI Recommendations – The recommendation engine, powered by reinforcement learning algorithms like DDPG and PPO, will simulate countless trading scenarios to find the most lucrative strategies. These recommendations will be displayed on a dynamic dashboard and updated in real time.

- Real-Time Alerts and Notifications – Cloud messaging technologies will be used to power the platform’s notification system so users will never miss a critical update. Investors will have customizable alerts that will focus on the metrics that matter most to them.

- Profiling Models – FinTractiv AI will adapt to your needs, whether you are a novice or an expert. It will use advanced profiling models to make specific recommendations based on your risk tolerance, investment goals, and trading history.

- Security and Scalability – The platform will be powered by cloud giants like AWS and will scale up when the trading hours reach their peak. FinTractiv AI will be intelligent and secure, with end-to-end encryption and GDPR-compliant practices to protect user data.

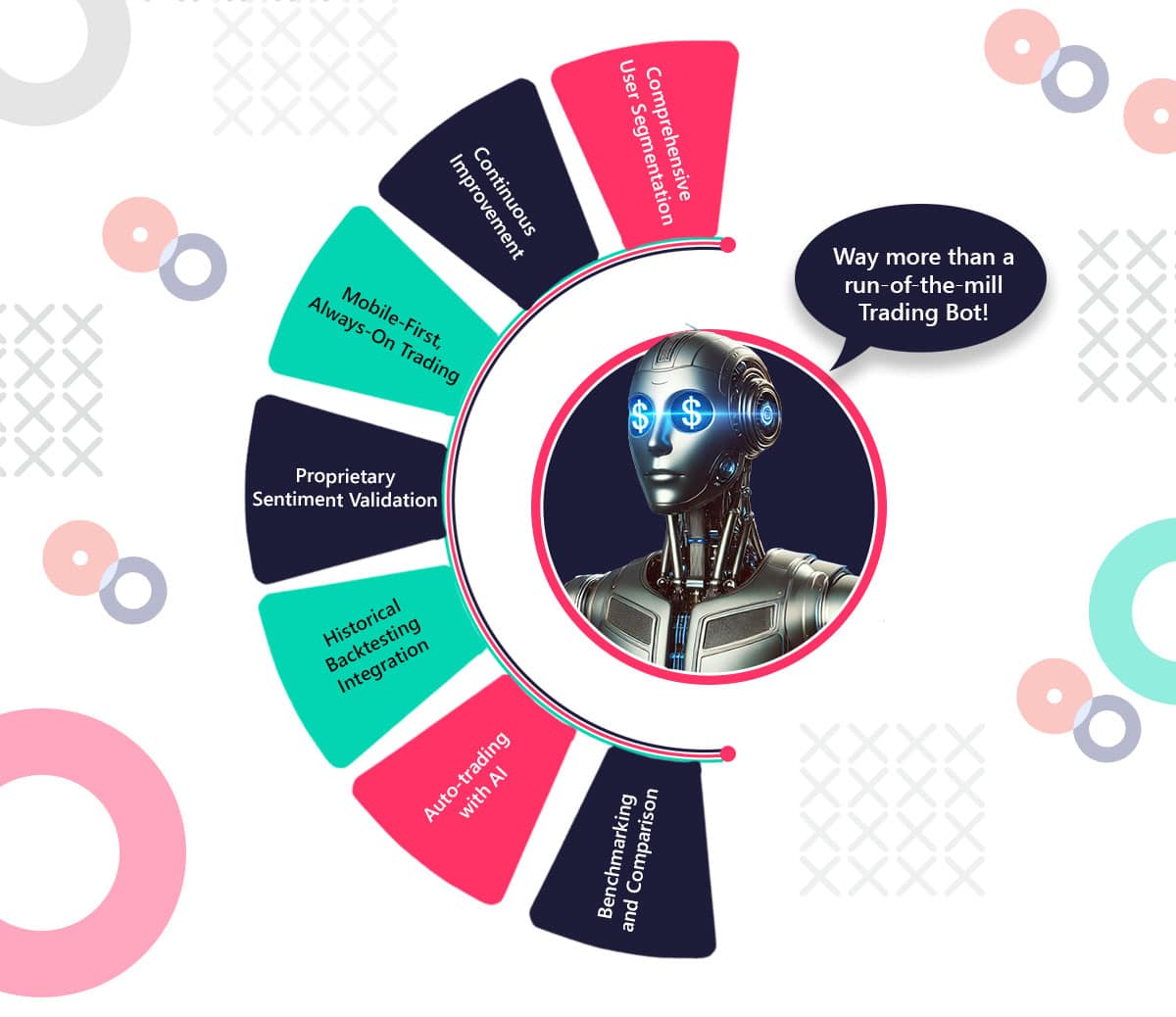

Why choose FinTractiv AI?

With so many trading bots available, what sets FinTractiv AI apart? The answer lies in its unique combination of features, reliability, and forward-thinking approach.

- Proprietary Sentiment Validation – FinTractiv AI is unlike other bots, which only aggregate social media sentiment and do not cross-validate with market statistics to filter out manipulation. This proprietary validation process will ensure that traders act on reliable, data-backed insights instead of social media buzz-fuelled pump-and-dump schemes.

- Comprehensive User Segmentation – FinTractiv AI isn’t a one-size-fits-all solution. Its ability to evolve with users—from beginner tutorials to advanced simulations—will ensure that traders at every stage of their journey feel supported and empowered.

- Historical Backtesting Integration – FinTractiv AI will also provide historical backtesting to inspire confidence by giving users the ability to evaluate how its recommendations would have performed in past market scenarios. This will set it apart in a field that is often criticized for lack of accountability.

- Mobile-First, Always-On Trading – The focus on a seamless mobile experience will make FinTractiv AI a truly modern trading tool that is perfect for the on-the-go lifestyle of today’s investors.

- Auto-trading with AI – With features like automated stop-loss triggers and automated trading with dynamic risk assessments and emotion-free trading decisions, FinTractiv AI will shield users from the pitfalls of emotional and impulsive trading.

- Benchmarking and Comparison – Comparing trading performance to the performance of major indices will provide a great reference point, allowing users to understand how their investments are faring and where they can improve their strategies.

- Continuous Improvement – VE’s commitment to user feedback and constant upgrades will ensure that FinTractiv AI stays ahead of the curve and adapts to the ever-changing financial landscape.

The Future is FinTractiv!

FinTractiv AI is currently being fine-tuned by VE’s AI team, and once ready, it will redefine how people think about investing. With real-time analyses, personalized strategies, and unmatched risk management features, it will make smart trading available to all. Whether you’re a fresher who wants to learn or a pro who wants to gain an edge, FinTractiv AI will be your sidekick in the tricky world of finance.

The future of trading is here, and it is intelligent, intuitive, and revolutionary!